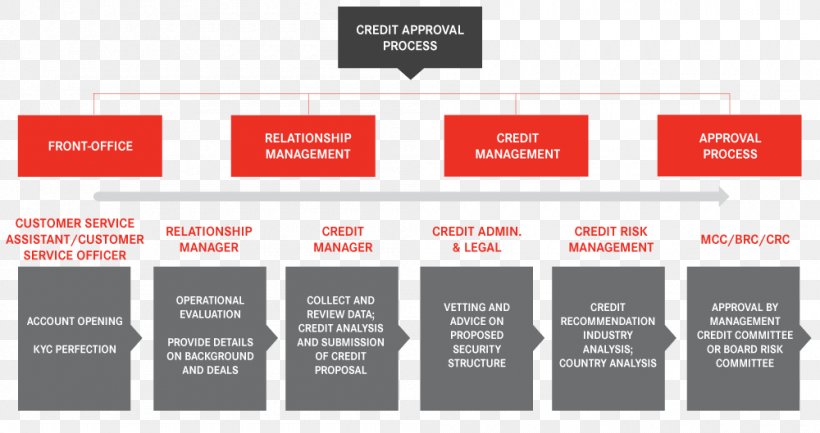

the performance of banks. This study reviews the relevant literature on banking risk management from diverse methodological strands and synthesises its conclusions to make an addition to the available knowledge; particularly to address certain research gaps regarding risk management and performance of banks in developing that operational risk management is a discipline with its own management structure, tools and processes, much like credit or market risk, is new (PWC, ). PWC () defined operational risk as the risk of direct or indirect loss resulting The overall framework of credit risk management in the bank comprises of following building blocks: 1. Credit Risk Management Structure. 2. Credit Risk Policy & Strategy. 3. Processes and Systems. CREDIT RISK MANAGEMENT STRUCTURE. Under overall credit risk management framework, the bank has put in place the following structure: blogger.comted Reading Time: 12 mins

Post a Comment. Pages Home Thesis Papers Internship Reports Assignments Class Notes ONLINE EARNING GAMES, dissertation on bank credit risk management. TABLE OF CONTENTS. Page No. EXECUTIVE SUMMARY. Objectives of the Report.

Scope of the Report. Structure of the Corporate Office. Mission Statement of Bank Asia. Corporate Objective. SWOT Analysis. Values Considered as Guiding Factors. Equity Formation. Performance of dissertation on bank credit risk management Bank.

Special Features of Bank Asia. Products and Services. Correspondence Banking. Types of Credit Facilities Offered by Bank Asia. Principals of Landing. Strategies of Lending Procedure.

Classification of Loans and Provisioning. Evaluation of Loan Products, Principals and Strategies. CREDIT PROCEDURE FOLLOWED BY BANK ASIA. Different Activities in Lending Process. Role of Different Organizational Levels in lending Process. Loan Process Schedule with PERT Network. Financial Spread Sheet Analysis. Importance of Financial Spread Sheet. Breakdown of Financial Spread Sheet. Requirement of Financial Spread Sheet. CRGM Used in Credit Evaluation. Definition of Credit Risk Grading CRG.

How to Compute Credit Risk Grading. Security for Loans and Advances. Attributes of Good Security. Documentation Against Advances. Modes of Creating Charge on Security. Purpose of Credit Risk Monitoring in Bank Asia. Credit Administration as a Tool of CRM.

Risk Grading as a Tool of Credit Monitoring. Early Warning System for Effective Monitoring. Loan Monitoring Through Continues Reporting. Borrower Selection.

Problems in Borrower Selection. Evaluation of the Branch Activities. Evaluation of the Corporate office Activities.

Evaluation of Credit Analysis. Evaluation of Lending Risk Analysis. Evaluation of Charge Creation. Evaluation of loan monitoring Techniques. FINDINGS OF THE REPORT. Major Findings of the Report. Identification Some Problems Regarding Credit Risk Management. The thesis mainly emphasizes the sequential activitiesinvolved in credit approval process, analytical techniques used by Bank Asiafor credit analysis as an integral part of the credit approval process, dissertation on bank credit risk management.

The thesis also focuses on the risk management techniques adopted by Bank Asia bothin pre-sanction and post-sanction period of a credit. Finally the reportincorporates an evaluation of the different aspects of the lending process andrisk management techniques and makes some recommendations.

Bank Asia offers both funded and non fundedcredit facilities to its customers. Bank Asia follows some specific principalsfor its credit activities, which involve Know Your Customer KYCsafety,liquidity, dissertation on bank credit risk management, profitability, purpose and spread. The lending procedure followed by Bank Asiaconsists of a set of sequential activities. In these sequential activities,both bank officials and potential borrowers play significant role.

Credit analysis if the borrower is foundsound for lending, the bank proceeds to prepare the credit proposal. The creditproposal consists mainly of a brief description of the borrower, purpose of theloan, collateral, and expiry of the credit line, amount, interest rate and theresult of the credit analysis. The credit proposal is prepared to facilitatethe approval of that particular loan either by Bank Asia credit committee or bythe Board of Directors.

Dissertation on bank credit risk management Asia does not have any fixed timeduration to complete lending process for a particular loan proposal. The totalduration of the time required to complete the lending process varies with thenature of credit, collection of information, nature of information, analysis ofinformation, preparation of the proposal, corporate office scrutiny, boardapproval, preparation of sanction advice, creation and collection of chargesdocuments and actual disbursement of loan.

Bank Asia must try to reduce the timerequired by a particular lending process to be completed. The higher duration,the higher the loan processing cost.

Bank Asia is currently facing problem inmobilizing its deposits in the form of credit. Number of banks operating in themarket is more but number dissertation on bank credit risk management potential and good borrower is less. ThereforeBank Asia should adopt aggressive marketingfor its loan products. The bank must find unexpected but profitable sector forfinancing. Board meeting for the approval of large loans shouldhave twice a month. Lending is the main income generatingactivity for all banks including Bank Asia.

Lending involves both risk andprofit. But a sound lending process supported by quantitative analysis,qualitative judgment and a separate credit monitoring cell can reduce the riskto a certain extent.

So far Bank Asia has maintained a very good loan portfolioand its lending process is reasonably sound. Bank Asia will be able to manageits lending process and management techniques more effectively andefficiently. In achievingthe aforesaid objectives of the Bank, Credit Operation of the Bank is of paramountimportance as the greatest share of total revenue of the Bank is generated fromit, maximum dissertation on bank credit risk management is centered in it and even the very existence of Bank dependson prudent management of its credit portfolio.

The failure of a commercial Bankis usually associated with the problem in credit portfolio and its less oftenthe result of shrinkage in the value of other assets. As such, credit portfolionot only features dominant in the assets structure of the Bank, it is cruciallyimportance to the success of the Bank also.

Retail banking is a major source of earning for BankAsia limited. The principal issue to beconsidered while giving the facilities to individual consumer or to groups isthe opportunity associated with such activities. Retail banking opportunity isanalyzed dissertation on bank credit risk management considering a number of factors involved in it. All financial institutions have theirindividual way of measuring and managing opportunity to keep it at the highestpossible level.

Theobjectives of the study are as follows:. Broad Objectives. The report mainly emphasizes thesequential activities involved in credit approval process, analyticaltechniques used by Bank Asia for credit analysis as an integral part of thecredit approval process. The report also focuses on the loan risk managementtechniques adopted by Bank Asia both in pre-sanction and post-sanction periodof a credit. Finally the report incorporates an evaluation of the differentaspects of the lending process and monitoring techniques and findings problemsand makes some recommendations.

Sources of Data Collection. Information used in this report has been collected fromboth primary and secondary sources. Majority of the information werecollected from the secondary sources, which include books, publications,reading materials and various circulars and reporters published by Bank Asia.

Data Analysis. This is adescriptive report mainly aiming to depict the credit approval process andmonitoring techniques of Bank Asia. Thestudy includes both qualitative and quantitative analysis of loan approvalprocess and monitoring tools. Based on the observational information writeralso tries to evaluate and analyze the problems involved in various phases ofthe credit approval process and Risk management techniques.

Presentation of Results and Recommendationsare made based on the critical evaluation of the different phases of processand techniques involved in credit approval and monitoring. There were certainlimitations regarding the study that is summarized below:.

CHAPTER 2.

Internship/Thesis/Dissertation Report on “Credit Risk Management of Bank Asia\

, time: 2:09

74 rows · Feb 12, · The thesis mainly emphasizes the sequential activitiesinvolved in credit Estimated Reading Time: 11 mins To start this thesis on Credit Appraisal and Credit Risk Management in the Nepalese Banking – A Case Study, I am going to describe banking industry as a producer of financial intermediation services in the economy and its definition in this chapter. I will also highlight the major problems in Nepali Banking system which are to be made corrected The overall framework of credit risk management in the bank comprises of following building blocks: 1. Credit Risk Management Structure. 2. Credit Risk Policy & Strategy. 3. Processes and Systems. CREDIT RISK MANAGEMENT STRUCTURE. Under overall credit risk management framework, the bank has put in place the following structure: blogger.comted Reading Time: 12 mins

No comments:

Post a Comment